In a financial system, Banks always are important.

Banks in SAP are used by the company codes for several purposes (payments, etc).

Companies have the House Banks, identified in the system as a unique Bank Id. The house banks have bank accounts, in this case identified with a Bank Account ID.

Taking into account theses concepts, the bank master data will contain the house bank id, the account numbers ids and the corresponding banks GL (and other information).

To Define House Banks, SAP provides transaction FI12 or following this path:

IMG->Financial Accounting (new)->Bank Accounting->Bank Accounts->Define House Banks

The definition of the rest of the banks (banks of customers or vendors) is done in SAP menu, using transaction FI01 or following the path:

SAP Menu->Accounting->Financial Accounting->Banks->Master Data->Bank Master Data->FI01 – Create

Showing posts with label SPRO. Show all posts

Showing posts with label SPRO. Show all posts

Thursday, December 13, 2012

Thursday, May 10, 2012

Number Ranges for Accounting Documents

Document number, a key concept used every day in our SAP work.

Have you ever asked how this number is generated? In this post you have the response.

SAP standard transaction to manage Number Ranges for Accounting Documents is FBN1

Also you can access following in customizing following path:

SAP Customizing Implementation Guide-> Financial Accounting (New) -> Financial Accounting Global Settings (New) -> Document -> Document Number Ranges -> Document in Entry View -> Define Document Number Ranges for Entry View

In the first screen, you have to enter the Company Code because document ranges depends on it.

In the second screen to set the ranges, you will see that document ranges for accounting also depends on fiscal year.

During each fiscal year, it is specified the range to be used when an accounting document is created, and for your information also you can see in the last document number created.

Wednesday, May 2, 2012

Splitting in General Accounting

To set-up the splitting in SAP, following steps have to be performed. Path in customizing to perform those steps is: Financial Accounting (New)->General Ledger Accounting (New)->Business Transactions->Document Splitting

1) Classify G/L Accounts for Document Splitting.

It is specified the item category and the account ranges to be managed in the splitting (Item category is derived from account type. For example, Vendors).

2) Classify Document Types for Document Splitting.

Each document type is associated to a business transaction type, so entering the business transaction and the variant in this screen, the corresponding type of document appear in this customizing.

3) Define Document splitting characteristic for General Ledger - Field “Zero Balance”: If you mark the flag, when the characteristic is not equal to zero, the system generates automatically a clearing line for balance purpose.

- Field “Partner field”: Is you specify this field, a sender/received relationship is documented the clearing line created additionally.

- Field “Mandatory field”: To force to fill a value.

4) Edit Constants for Nonassigned processes

In customizing also is defined which constant is set when the derivation is not possible, for example “Dummy” (Edit Constant for no assignment processes).

5) Activate Document splitting

Splitting has to be activated in customizing and select the method for the splitting.

- Field “Inheritance”: If you mark this flag, the document splitting characteristics for General Accounting are forwarded to lines that not have any assignments.

- Field “Standard Account Assignment”: A constant value is inherited in the splitting lines.

6) Extended Document Splitting->Define Document Splitting Method

Is defined the method to be used in the previous step when we are activating the splitting.

7) Extended Document Splitting->Define Document Splitting Rule

Perhaps this is the most important step in the splitting. During the process of splitting each business transaction entered here is analyzed specifying its business transaction variant. The splitting will be done following a “Processing category” specified, for example “1-Splliting based on base item categories”. And in this step also we specified which those base item categories are in order to perform correctly the splitting.

8) Extended Document Splitting->Assign Document Splitting Method

Is the same step than step 5.

9) Extended Document Splitting->Define Business transaction Variants

Variants used in step 7 are defined here and item categories are assigned to the variants in order to be used also in step 7.

To have a clear picture for splitting, the best option is show an example. If have these customizing done following previous steps:

Step1: (Accounts to be split) Item Category “0001” for Vendor accounts from 4000000 to 4100000. Also we have the Item Categories used as base for the splitting, for example “0002” will be Expenses and “0003” will be Revenues.

Step2: (Documents to be split) Business transaction “0001” with variant “0001”for documents KR (Vendor Invoices)

Step3: Profit Center has been selected for splitting

Step4: None in this example.

Step5: Method “0000000001” is activated, with Inheritance.

Step6: Method “0000000001” is defined.

Step7: For method “0000000001”, business transaction “0001” and variant (KR Invoices) and item category “0001” (vendor accounts 4000000 to 4100000) the splitting will be done following the “Processing Category” for example “1” where means “Splitting based on base item categories” and in this case we will indicate the “base item categories” to perform the splitting, for example item category “0002” Expenses and “0003” Revenues.

Step8: Same than 5.

Step9: Is defined the variant “0001”.

With this example when we enter a Vendor Invoice KR and we use 1 vendor account between 4000000 and 410000 and 2 expenses accounts (each one with a different profit center), the splitting will split the item line of the vendor in two items, because the item of the vendor fulfill with the configuration to be done the splitting, and the splitting will be done in base on the two items of expenses (as has been specified in the configuration), so the new two lines of the vendor will have each one a different profit center assigned, one from the first expense and other one from the second.

1) Classify G/L Accounts for Document Splitting.

It is specified the item category and the account ranges to be managed in the splitting (Item category is derived from account type. For example, Vendors).

2) Classify Document Types for Document Splitting.

Each document type is associated to a business transaction type, so entering the business transaction and the variant in this screen, the corresponding type of document appear in this customizing.

3) Define Document splitting characteristic for General Ledger - Field “Zero Balance”: If you mark the flag, when the characteristic is not equal to zero, the system generates automatically a clearing line for balance purpose.

- Field “Partner field”: Is you specify this field, a sender/received relationship is documented the clearing line created additionally.

- Field “Mandatory field”: To force to fill a value.

4) Edit Constants for Nonassigned processes

In customizing also is defined which constant is set when the derivation is not possible, for example “Dummy” (Edit Constant for no assignment processes).

5) Activate Document splitting

Splitting has to be activated in customizing and select the method for the splitting.

- Field “Inheritance”: If you mark this flag, the document splitting characteristics for General Accounting are forwarded to lines that not have any assignments.

- Field “Standard Account Assignment”: A constant value is inherited in the splitting lines.

6) Extended Document Splitting->Define Document Splitting Method

Is defined the method to be used in the previous step when we are activating the splitting.

7) Extended Document Splitting->Define Document Splitting Rule

Perhaps this is the most important step in the splitting. During the process of splitting each business transaction entered here is analyzed specifying its business transaction variant. The splitting will be done following a “Processing category” specified, for example “1-Splliting based on base item categories”. And in this step also we specified which those base item categories are in order to perform correctly the splitting.

8) Extended Document Splitting->Assign Document Splitting Method

Is the same step than step 5.

9) Extended Document Splitting->Define Business transaction Variants

Variants used in step 7 are defined here and item categories are assigned to the variants in order to be used also in step 7.

To have a clear picture for splitting, the best option is show an example. If have these customizing done following previous steps:

Step1: (Accounts to be split) Item Category “0001” for Vendor accounts from 4000000 to 4100000. Also we have the Item Categories used as base for the splitting, for example “0002” will be Expenses and “0003” will be Revenues.

Step2: (Documents to be split) Business transaction “0001” with variant “0001”for documents KR (Vendor Invoices)

Step3: Profit Center has been selected for splitting

Step4: None in this example.

Step5: Method “0000000001” is activated, with Inheritance.

Step6: Method “0000000001” is defined.

Step7: For method “0000000001”, business transaction “0001” and variant (KR Invoices) and item category “0001” (vendor accounts 4000000 to 4100000) the splitting will be done following the “Processing Category” for example “1” where means “Splitting based on base item categories” and in this case we will indicate the “base item categories” to perform the splitting, for example item category “0002” Expenses and “0003” Revenues.

Step8: Same than 5.

Step9: Is defined the variant “0001”.

With this example when we enter a Vendor Invoice KR and we use 1 vendor account between 4000000 and 410000 and 2 expenses accounts (each one with a different profit center), the splitting will split the item line of the vendor in two items, because the item of the vendor fulfill with the configuration to be done the splitting, and the splitting will be done in base on the two items of expenses (as has been specified in the configuration), so the new two lines of the vendor will have each one a different profit center assigned, one from the first expense and other one from the second.

Monday, April 30, 2012

Activation of New General Ledger

A small action, a big change! The benefits of the New General Ledger is explained in a separated post. Now we indicate how to activate it. New General ledger is activated following the path in customizing:

SPRO-> SAP Customizing Implementation Guide->Financial Accounting>Financial Accouting Global Settings->Activate New General Ledger Accounting

The activation will modify paths in customizing, changing the menu to “Financial Accounting (New)” and “General Ledger Accounting (New)”.

SPRO-> SAP Customizing Implementation Guide->Financial Accounting>Financial Accouting Global Settings->Activate New General Ledger Accounting

The activation will modify paths in customizing, changing the menu to “Financial Accounting (New)” and “General Ledger Accounting (New)”.

Company Code is Productive

With SAP transaction OBY6 we set Company Code global data.

In particular there is a checkbox called “Company Code is Productive”. If you mark the checkbox, the Transactional Data or Master Data can not be deleted from the system.

Usually the flag is marked in production environment but not in development or integration environment because it could be useful for test purposes delete the data created during a test phase in order to have the system clean of data for the starting of following test phase.

Additionally to SAP transaction OBY6, the checkbox could be reached in customizing (SPRO) following the path:

In particular there is a checkbox called “Company Code is Productive”. If you mark the checkbox, the Transactional Data or Master Data can not be deleted from the system.

Usually the flag is marked in production environment but not in development or integration environment because it could be useful for test purposes delete the data created during a test phase in order to have the system clean of data for the starting of following test phase.

Additionally to SAP transaction OBY6, the checkbox could be reached in customizing (SPRO) following the path:

Sunday, April 29, 2012

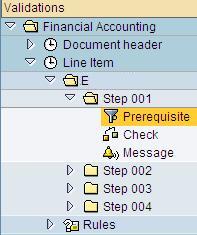

Validation of Accounting Document

SAP transaction for creating validations in FI Module is OB28. Also there is a global transaction GGB0 where the developer can create validations in others SAP modules, included FI.

With the new Financial Acounting (New), there are several paths to reach the transaction from Customizing (SPRO transaction), for example:

One validation can be built by a large number of steps (up to 999) and each step is described by following statements:

Prerequisite: Determines when the value entered should be checked.

Check: Determines when the value entered is valid. Is True the transaction continue, else a message is displayed.

Message: Determine the message to be shown if the check is false.

With the new Financial Acounting (New), there are several paths to reach the transaction from Customizing (SPRO transaction), for example:

Prerequisite: Determines when the value entered should be checked.

Check: Determines when the value entered is valid. Is True the transaction continue, else a message is displayed.

Message: Determine the message to be shown if the check is false.

Subscribe to:

Posts (Atom)